Understanding Pendle Finance: A Visual Guide

Pendle Finance is revolutionizing DeFi by tokenizing future yield. This guide breaks down exactly how it works through clear visuals and explanations.

If you've been involved in DeFi, you know that yields are unpredictable. Staking yields fluctuate, lending rates change, and liquidity mining rewards vary constantly. This volatility makes it difficult to plan or predict your returns.

Pendle Finance solves this by introducing a revolutionary concept: separating an asset's principal from its yield. This allows you to trade future yield as if it were a separate asset, opening up entirely new strategies for managing your DeFi positions.

Let's dive into how this works, starting with the core mechanism.

How Yield Tokenization Works

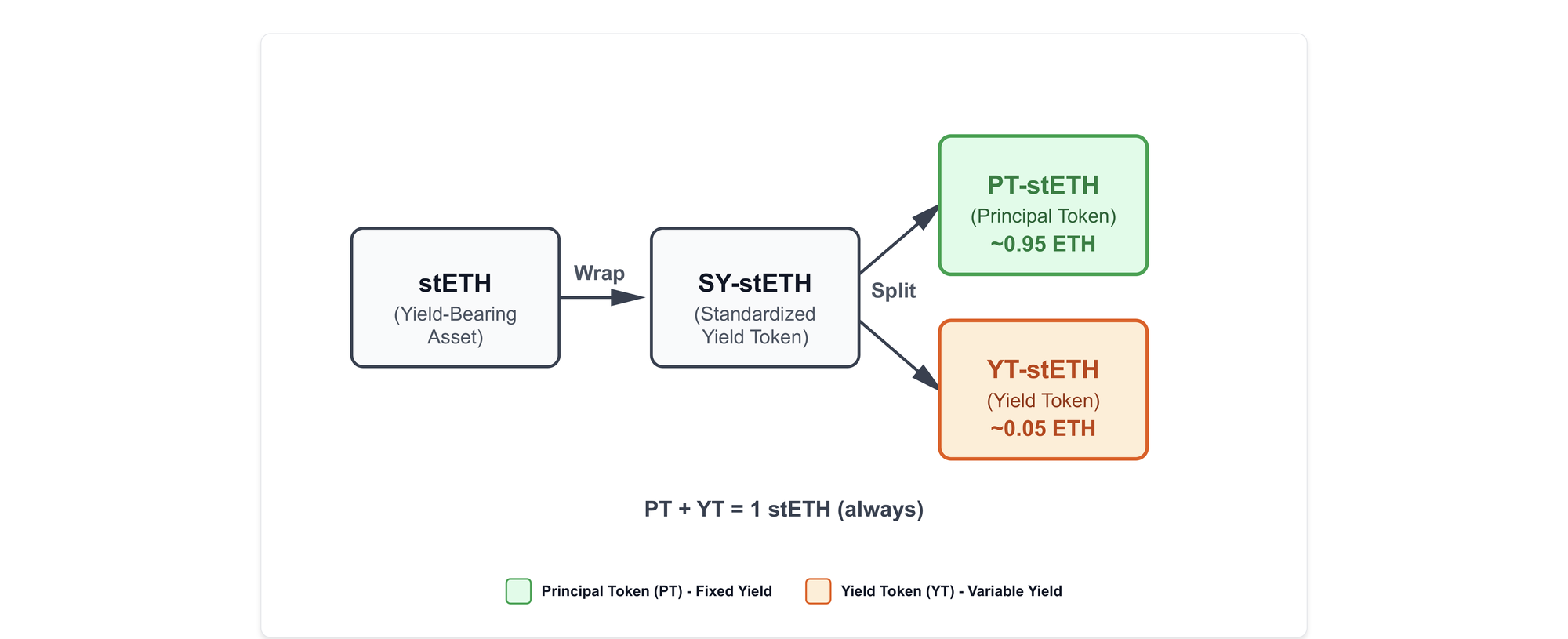

The magic of Pendle starts with yield tokenization – the process of splitting a yield-bearing asset into two distinct tokens. Think of it like separating a fruit into its flesh and its seed: both are valuable, but serve different purposes.

When you deposit a yield-bearing asset like stETH (staked Ethereum) into Pendle, the protocol performs three steps:

- Wrapping: Your stETH is wrapped into SY-stETH (Standardized Yield token)

- Splitting: SY-stETH is split into PT-stETH (Principal Token) and YT-stETH (Yield Token)

- Trading: Both tokens can now be traded independently on Pendle's AMM

From yield-bearing asset to tradeable PT and YT tokens

Here's the crucial insight: PT + YT always equals the full underlying asset. If PT-stETH is trading at 0.95 ETH, then YT-stETH must be worth 0.05 ETH. This mathematical relationship is what makes the entire system work.

Key Concept: Principal Tokens (PT) represent your right to redeem the full underlying asset at maturity. Yield Tokens (YT) represent your right to collect all yield generated until maturity. After maturity, PT can be redeemed 1:1 for the asset, while YT becomes worthless.

Understanding Principal Tokens (PT)

Principal Tokens are like zero-coupon bonds in traditional finance. You buy them at a discount and redeem them at face value at maturity.

How PT Works:

- Buy PT-stETH for 0.92 ETH today

- At maturity (e.g., 1 year), redeem for 1 stETH

- Your locked-in return: ~8.7% APY

The discount represents your fixed yield. No matter what happens to stETH yields during that year – whether they spike to 10% or drop to 2% – you get your 8.7% return.

Who should buy PT?

- Investors seeking predictable returns

- Those planning for future expenses

- Anyone hedging against declining yields

- Conservative DeFi participants wanting stability

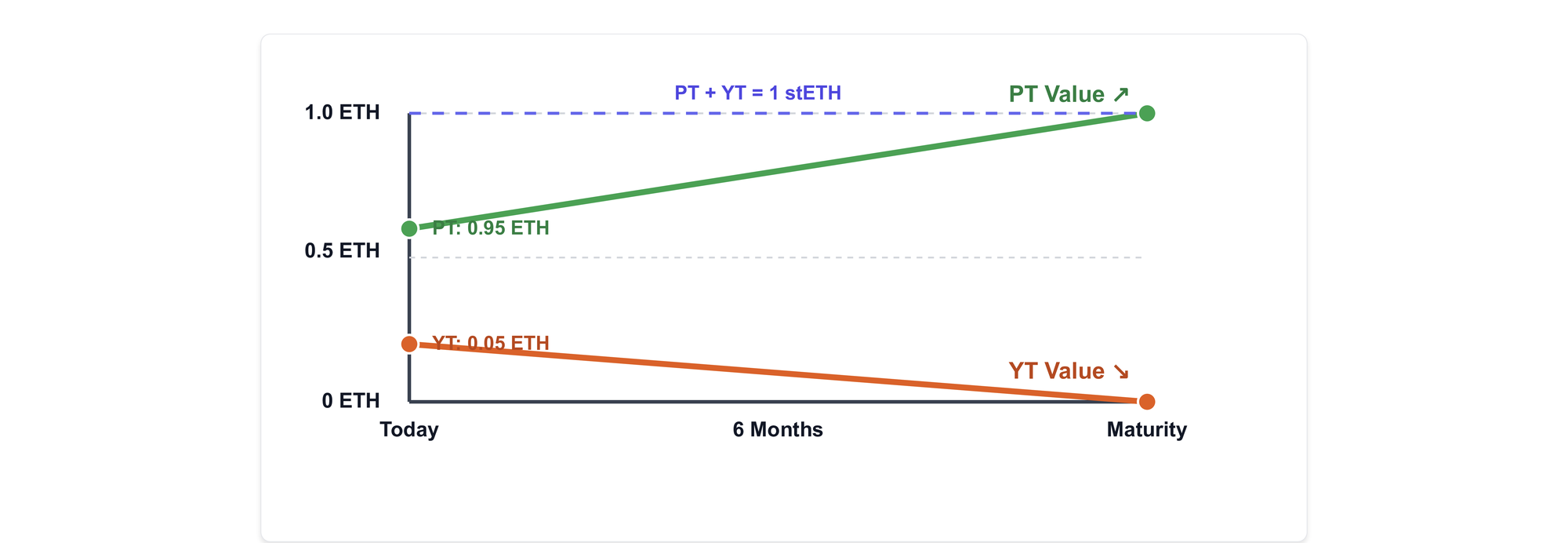

PT tokens increase in value as they approach maturity, eventually reaching 1:1 parity with the underlying asset.

Understanding Yield Tokens (YT)

Yield Tokens are the speculative side of Pendle. They give you exposure to all future yield generated by an asset, but they expire worthless at maturity.

How YT Works:

- Buy YT-stETH for 0.05 ETH today

- Collect all staking rewards until maturity

- If yields exceed what you paid (the "implied APY"), you profit

- If yields are lower, you lose money

Think of YT as a bet on yield rates. The price of YT reflects the market's expectations for future yields (called "Implied APY"). If actual yields exceed this, YT holders profit.

Example Scenario:

- Current stETH yield: 4%

- You buy YT-stETH priced at 4% implied APY

- If actual yields average 6% → You profit

- If actual yields average 3% → You lose money

Who should buy YT?

- Traders who believe yields will increase

- Those seeking leveraged yield exposure

- Speculators with strong yield predictions

- Risk-tolerant DeFi participants

How token values evolve as maturity approaches

Three Ways to Use Pendle

Now that you understand how tokenization works, let's explore the three main strategies traders use on Pendle. Each strategy serves a different purpose and risk profile.

Strategy 1: Lock in Fixed Yields (Buy PT)

If you're tired of volatile yields and want predictable returns, buying PT is your strategy. By purchasing PT at a discount, you lock in a fixed yield until maturity – similar to buying a zero-coupon bond in traditional finance.

Example:

Buy PT-stETH: 0.92 ETH

Maturity: 1 year

Redeem for: 1 stETH

Fixed Return: ~8.7% APY

This strategy works regardless of market conditions. Whether staking yields soar or crash, your return is locked in.

Strategy 2: Speculate on Rising Yields (Buy YT)

Think staking yields are going to increase? Buy YT tokens to bet on that thesis. If yields rise above the price you paid (the "implied APY"), you profit. This gives you leveraged exposure to yield fluctuations.

Example:

Buy YT-stETH: 0.04 ETH (4% implied APY)

Actual yields: 6% average

Your exposure: 1 full stETH worth of yield

Result: Profit from the 2% difference

The smaller your initial investment (lower YT price), the more leveraged your position. A small increase in yields can result in significant returns.

Strategy 3: Provide Liquidity (Earn Fees)

Don't want to pick a side? Provide liquidity to PT/SY pools and earn trading fees plus PENDLE token rewards. Lock your PENDLE as vePENDLE to boost rewards by up to 250%.

Benefits:

- Earn trading fees from every swap

- Receive PENDLE token incentives

- Up to 250% boost with vePENDLE

- Less impermanent loss than traditional AMMs

- Passive income stream

Choose your approach based on your market outlook and risk tolerance

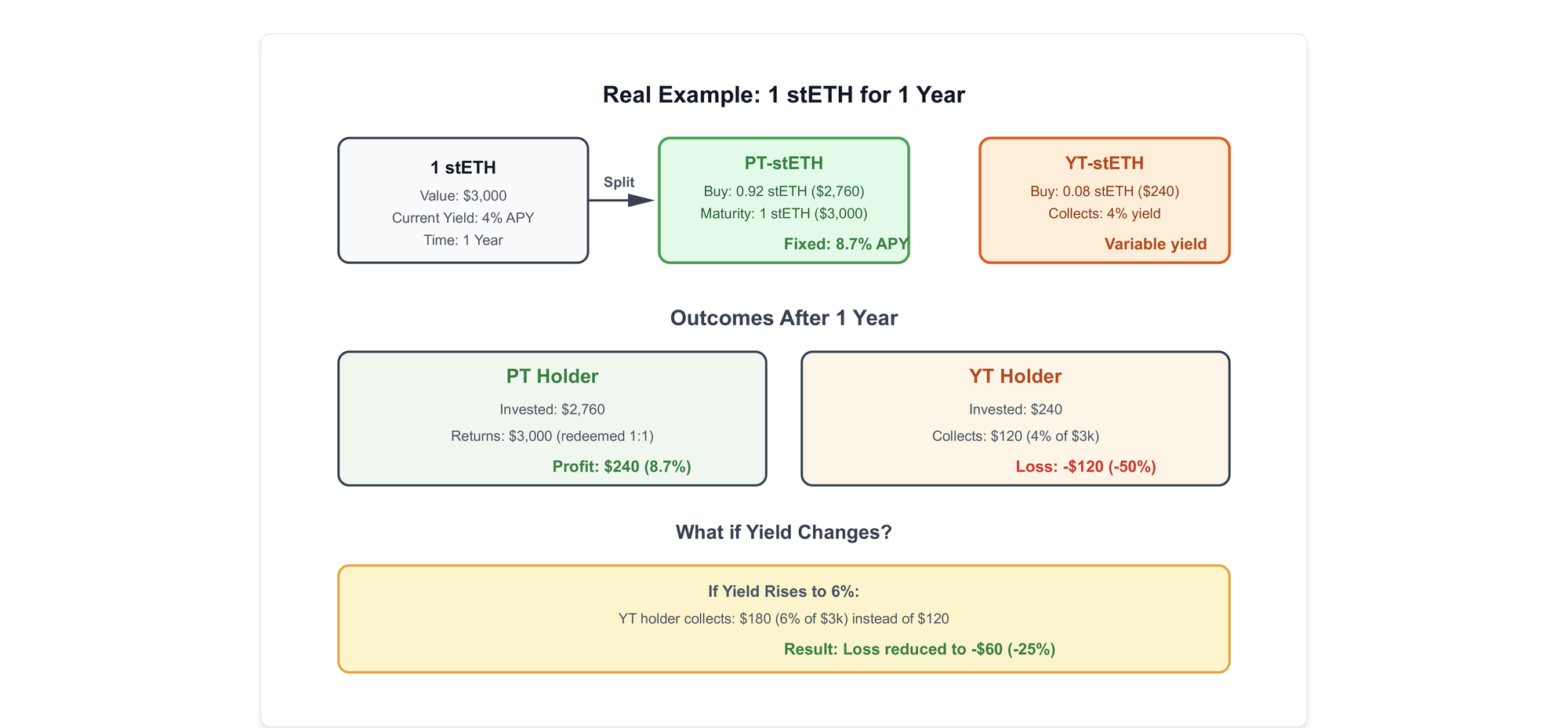

Real World Example: Breaking Down 1 stETH

Let's walk through a concrete example with real numbers to see how this works in practice.

Initial Setup:

- Asset: 1 stETH

- Current value: $3,000

- Current yield: 4% APY

- Time period: 1 year

After Tokenization:

PT-stETH:

- Purchase price: 0.92 stETH ($2,760)

- Maturity value: 1 stETH ($3,000)

- Fixed return: $240 (8.7% APY)

- Risk: None (guaranteed)

YT-stETH:

- Purchase price: 0.08 stETH ($240)

- Implied APY: 4%

- Break-even: Yields must average 4%

- Risk: High (can lose entire investment)

Scenario 1: Yields Stay at 4%

- YT holder collects: $120 (4% of $3,000)

- YT cost: $240

- Result: -$120 loss (-50%)

Scenario 2: Yields Rise to 6%

- YT holder collects: $180 (6% of $3,000)

- YT cost: $240

- Result: -$60 loss (-25%)

Scenario 3: Yields Rise to 8%

- YT holder collects: $240 (8% of $3,000)

- YT cost: $240

- Result: Break even

Scenario 4: Yields Rise to 12%

- YT holder collects: $360 (12% of $3,000)

- YT cost: $240

- Result: +$120 profit (+50%)

As you can see, YT holders need yields to significantly exceed the implied APY to profit, but the upside can be substantial if they're right.

A concrete walkthrough of how 1 stETH splits and potential outcomes

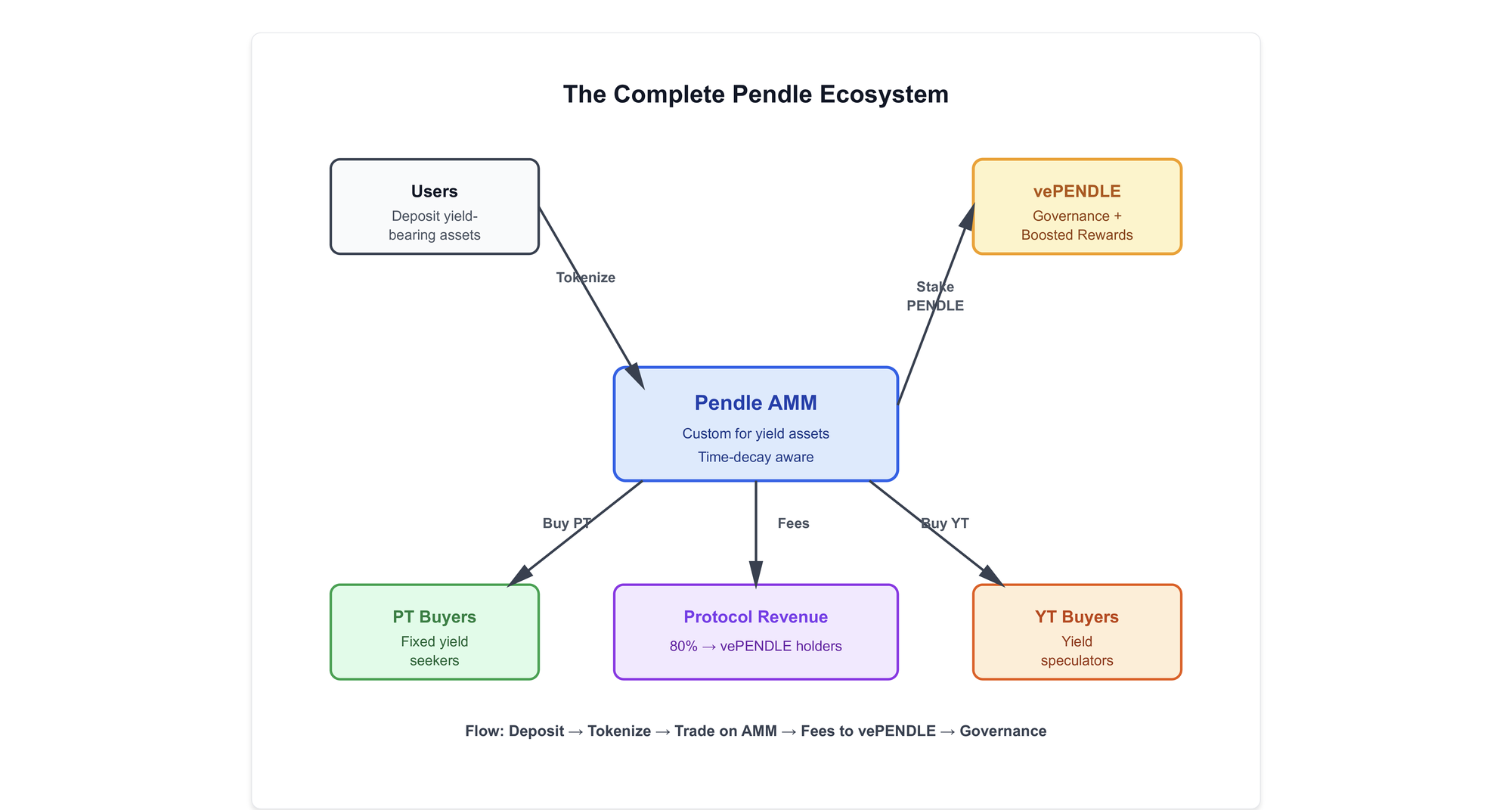

The Pendle AMM: Built for Yield Trading

Pendle uses a custom Automated Market Maker (AMM) specifically designed for time-decaying assets. Traditional AMMs like Uniswap aren't optimized for assets that lose value over time (like YT approaching maturity), but Pendle's AMM accounts for this.

Key Features:

Time Decay Integration The AMM's pricing algorithm accounts for the time remaining until maturity. As PT approaches maturity, its price naturally converges toward 1:1 with the underlying asset.

Concentrated Liquidity Similar to Uniswap V3, Pendle uses concentrated liquidity to improve capital efficiency. Liquidity providers can focus their capital where it's needed most.

Reduced Impermanent Loss Because PT naturally approaches the price of the underlying asset at maturity, impermanent loss is minimized compared to traditional AMM pairs.

Dynamic Pricing Curves The AMM adjusts pricing curves based on time to maturity, ensuring fair and efficient markets throughout the token's lifetime.

The PENDLE Token & vePENDLE

The PENDLE token powers the entire ecosystem, providing governance and incentive mechanisms.

Staking for vePENDLE

Lock your PENDLE tokens to receive vePENDLE (vote-escrowed PENDLE), which grants:

- Governance Rights: Vote on protocol decisions and proposals

- Boosted Rewards: Up to 250% boost on liquidity provision rewards

- Revenue Share: Receive 80% of protocol swap fees

- Yield from Unredeemed PTs: Additional passive income stream

The longer you lock your PENDLE, the more vePENDLE you receive and the stronger your voting power.

The Pendle Wars

Similar to Curve's "vote wars," protocols compete for vePENDLE influence to direct liquidity incentives to their pools. This creates a competitive market where:

- Protocols accumulate vePENDLE to boost their pools

- vePENDLE holders vote on where incentives flow

- Bribes and incentives drive value to PENDLE holders

- The system creates sustainable protocol-owned liquidity

Token Economics

- Current Emissions: 216,076 PENDLE per week (as of Sept 2024)

- Emission Schedule: 1.1% weekly decrease until April 2026

- Terminal Inflation: 2% annually after April 2026

- Token Distribution: All team/investor tokens fully vested (Sept 2024)

This emission schedule ensures long-term sustainability while providing sufficient incentives for early adopters.

How all components work together: users, AMM, governance, and rewards

Use Case: Liquid Restaking Tokens

One of Pendle's most popular applications involves Liquid Restaking Tokens (LRTs) from protocols like EigenLayer. This demonstrates the protocol's versatility and composability.

The Setup:

- Deposit ETH into a liquid restaking protocol (Renzo, ether.fi, etc.)

- Receive LRT (ezETH, eETH) that generates multiple yield streams:

- Ethereum staking rewards (~4%)

- EigenLayer restaking rewards (~2-8%)

- Potential protocol points/airdrops

- Tokenize on Pendle by wrapping into SY-ezETH

- Split into PT and YT for trading

Strategy Options:

For Fixed Yield Seekers:

- Buy PT-ezETH at discount

- Lock in total fixed yield (staking + restaking)

- Maintain exposure to potential airdrops

- No yield volatility risk

For Yield Speculators:

- Buy YT-ezETH if you expect restaking yields to increase

- Leveraged exposure to EigenLayer reward changes

- Higher risk but potentially massive upside

- Bet on ecosystem growth

For Point Farmers:

- Provide liquidity to earn PENDLE + protocol points

- Maximize exposure to multiple airdrop opportunities

- Earn while waiting for token launches

This combination has driven billions in TVL to Pendle, as users seek to maximize their exposure to the restaking ecosystem while maintaining flexibility.

Risks & Considerations

While Pendle offers powerful tools, users should be aware of several risks before diving in.

Smart Contract Risk

Pendle adds complexity on top of already complex DeFi protocols. While extensively audited by reputable firms (6 audits to date), smart contracts can have undiscovered vulnerabilities.

Mitigation:

- Start with small amounts

- Understand what you're interacting with

- Check audit reports before using new pools

- Monitor the protocol's security track record

Impermanent Loss for LPs

While Pendle's AMM minimizes IL compared to traditional pools, liquidity providers still face some risk, especially if they provide liquidity far from maturity.

Active Management Required

Unlike "set and forget" staking, Pendle requires attention:

- PT and YT tokens have expiration dates

- Need to migrate to new pools after maturity

- Monitor yield trends for optimal entry/exit

- Track multiple maturity dates if holding various positions

Underlying Protocol Risk

Your returns depend on the safety of the base protocol. If stETH depegs or a restaking protocol is exploited, your PT/YT positions are affected.

Examples:

- Lido slashing events affect stETH value

- LRT protocol exploits impact all derivative tokens

- Smart contract bugs in base protocols cascade

Yield Prediction Complexity

YT speculation requires understanding:

- Historical yield trends

- Upcoming protocol changes

- Market dynamics affecting yields

- Network activity patterns

- Validator behavior

Getting these predictions wrong can result in significant losses, especially given YT's leveraged nature.

Liquidity Considerations

- Some pools have limited liquidity

- Larger trades face higher slippage

- Exit liquidity varies by maturity date

- Popular pools trade better than obscure ones

Getting Started with Pendle

Ready to try Pendle? Here's how to get started with each strategy.

For Fixed Yield Seekers

- Visit pendle.finance

- Connect your wallet (MetaMask, WalletConnect, etc.)

- Navigate to "Trade" tab

- Select a PT for your desired asset

- Check the fixed APY displayed

- Compare with current yields to assess value

- Purchase PT and hold until maturity

- Redeem 1:1 for underlying asset at maturity

Tips:

- Higher fixed APY = better deal

- Compare across different maturity dates

- Consider gas costs for small purchases

- Plan redemption timing

For Yield Speculators

- Research upcoming events that might boost yields

- Navigate to "Trade" tab

- Select a YT for your target asset

- Analyze current vs. expected yields

- Check implied APY vs your prediction

- Purchase YT if you expect yields to rise

- Monitor yield performance

- Sell early if yields move in your favor or hold for full period

Tips:

- Only buy YT if you have strong yield thesis

- Start small while learning

- Set mental stop-losses

- Don't forget YT expires worthless

For Liquidity Providers

- Navigate to "Earn" tab

- Select a pool with attractive APY

- Review pool composition (usually SY + PT)

- Deposit both tokens in required ratio

- Receive LP tokens

- Earn trading fees + PENDLE rewards

- Consider locking PENDLE for vePENDLE to boost returns

- Monitor pool performance and migrate as needed

Tips:

- Start with popular, liquid pools

- Understand IL risks before depositing

- Lock PENDLE early for maximum boost

- Compound rewards regularly

Advanced Strategies

Once you're comfortable with the basics, explore these sophisticated approaches.

The Basis Trade

Simultaneously mint and split, then trade components:

1. Deposit 1 stETH → Get 1 PT + 1 YT

2. Immediately sell YT for current market price

3. Hold PT for fixed return

4. Result: Fixed yield + upfront capital from YT sale

This strategy effectively "pre-sells" your yield for immediate liquidity while maintaining principal.

Yield Curve Trading

Trade based on yield curve shape:

- Compare yields across different maturities

- If short-term yields > long-term (inverted curve):

→ Buy short maturity PT for better rates

- If curve normalizes:

→ Roll into longer maturities

- Profit from yield curve movements

The Looping Strategy

Amplify fixed yield returns using leverage:

1. Buy PT at discount

2. Use PT as collateral in lending protocols

3. Borrow more assets

4. Buy more PT

5. Repeat for leveraged exposure

Warning: This significantly increases risk and liquidation potential. Only for experienced users.

Point Farming Optimization

Maximize airdrop exposure:

1. Hold PT for underlying protocol airdrops

2. Provide LP to earn PENDLE

3. Stake PENDLE for vePENDLE

4. Use vePENDLE to boost all rewards

5. Accumulate points from multiple sources simultaneously

The Future of Pendle

Pendle's team has outlined ambitious plans for continued growth and innovation.

2025 Roadmap

Near-Term Goals:

- Integration with 10+ new yield-bearing protocols

- Expansion to 5 additional blockchain networks

- Enhanced analytics dashboard for traders

- Improved UX for mainstream adoption

- Mobile app launch

Long-Term Vision:

- Becoming the standard for interest rate derivatives in DeFi

- Integration with institutional DeFi platforms

- Cross-chain yield markets via LayerZero

- Real-world asset (RWA) integration

- Options and perpetuals on PT/YT

Potential Future Features

Options on PT/YT

- Call/put options for advanced hedging

- Structured products combining multiple strategies

- Enhanced risk management tools

Perpetual Yield Markets

- Trade yield exposure without expiration

- Continuous liquidity across maturity dates

- More capital-efficient positions

Automated Strategies

- Yield optimization vaults

- Auto-rolling positions at maturity

- Smart routing across multiple pools

TradFi Integration

- Bridges to traditional finance

- Institutional-grade reporting

- Compliance-friendly structures

Why Pendle Matters for DeFi

Pendle represents a significant milestone in DeFi's evolution for several critical reasons.

Financial Sophistication

Pendle brings TradFi-level instruments to DeFi, demonstrating that the space is maturing beyond simple swapping and lending. Interest rate derivatives, a $400T+ market in traditional finance, now have a decentralized counterpart.

Risk Management Tools

For the first time, DeFi users have robust tools to hedge interest rate risk. This is essential for institutional adoption, as traditional finance requires predictable yields for treasury management and financial planning.

Capital Efficiency

By unlocking liquidity from locked yield-bearing positions, Pendle improves overall capital efficiency in DeFi. Assets that would otherwise sit idle can now be productive in multiple ways simultaneously.

Composability Showcase

Pendle demonstrates DeFi's superpower: composability. It builds on top of staking protocols, restaking platforms, and lending markets – combining and enhancing existing protocols in novel ways.

Market Price Discovery

By creating secondary markets for future yields, Pendle provides valuable price discovery. The implied APY serves as a market prediction for future yields, offering insights to the entire DeFi ecosystem.

Conclusion

Pendle Finance represents one of the most innovative protocols in DeFi today. By tokenizing and enabling the trading of future yield, it brings sophisticated fixed-income strategies to the decentralized world.

Key Takeaways:

- Yield Tokenization: Separating principal and yield creates new trading opportunities

- Three Strategies: Fixed yields (PT), yield speculation (YT), or liquidity provision

- Custom AMM: Built specifically for time-decaying yield assets

- vePENDLE: Governance and boosted rewards for long-term supporters

- Real Utility: Already over $5B TVL and growing rapidly

Whether you're seeking predictable returns through Principal Tokens, speculating on yield increases with Yield Tokens, or providing liquidity for trading fees, Pendle offers tools previously unavailable in DeFi.

The protocol's trajectory – from a $3.7M seed round in 2021 to over $5B in TVL – demonstrates strong market demand for yield management solutions. As DeFi matures and attracts institutional participants, protocols like Pendle that bridge traditional and decentralized finance will become increasingly important.

However, Pendle isn't for everyone. The complexity of yield tokenization, time-decaying assets, and active position management means users need solid understanding of both DeFi mechanics and interest rate dynamics. But for those willing to learn, Pendle opens up entirely new strategies for optimizing returns and managing risk.

Ready to explore? Visit pendle.finance and start with small amounts while you learn. The future of yield trading is here – and it's on-chain.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always do your own research before interacting with any DeFi protocol. DeFi investments carry significant risks, including the potential loss of your entire investment.

Published by ReDefi Software Ltd. - For more technical guides on crypto, coding, and DeFi, subscribe to our newsletter.